91ĘÓƵ Activity Collapses as Coronavirus Forces Broad Economic Contraction

The reading hits a record low as new orders contract, exports shrink and unemployment soars.

Share

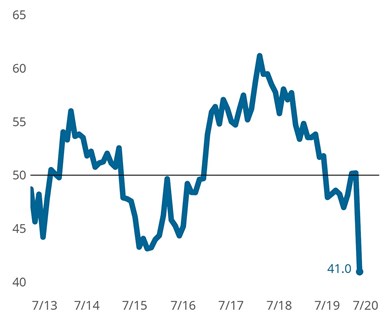

91ĘÓƵ Business Index: The metalworking industry has not been spared from the forced closure of much of the world’s economy in order to battle the coronavirus. After reporting a nascent rebound in economic conditions earlier in 2020, the 91ĘÓƵ Index plummeted to an all-time low in March.

With a reading of 41.0, the Gardner Business Index (GBI): 91ĘÓƵ reported the lowest reading in its more than eight-year history. ’s review of the six underlying industry components — whose average is calculated for the reading — observed all-time lows for new orders, exports and employment.

It is important to remember that these readings represent the breadth of change occurring within the metalworking industry, not the rate of decline. As such, these low readings indicate only that a large proportion of metalworking manufacturers reported some decreased level of business activity. The reading does not quantify the magnitude of the downward change.

Manufacturers Report Lengthening Supplier Deliveries While New Orders Fall to All-Time Low: Survey respondents reported a steep contraction among most elements of business activity. The reading for supplier deliveries moved higher as supplier deliveries slowed due to the massive economic disruption being caused by COVID-19. In normal times, the supplier deliveries reading moves higher when suppliers’ backlogs grow, causing longer delivery times.

Unlike the other components of the 91ĘÓƵ Index, the reading for supplier deliveries moved significantly higher. The reason for this has to do with how the supplier delivery question is asked (responses are either “slower,” “same” or “faster”). In normal times, when demand for upstream goods is high, supply chains cannot keep pace with these orders. The resulting backlog of supplier orders thus lengthens their delivery times. This delay causes our surveyed companies to report slowing deliveries and, by our survey’s design, this elevates the supplier deliveries reading. The world’s efforts to slow the spread of COVID-19 have significantly disrupted supply chains worldwide. It is thus due to this disruption, as opposed to strong demand for upstream products overall, that supplier delivery times have lengthened and the reading has increased.

Related Content

-

91ĘÓƵ Activity Stabilizes in July

July closed at 44.2, which interrupts what had been three months straight of accelerating contraction.

-

91ĘÓƵ Activity is Nearing a Full Year of Contraction

91ĘÓƵ activity has contracted since October of 2022.

-

Last Chance! 2025 Top Shops Benchmarking Survey Still Open Through April 30

Don’t miss out! Modern Machine Shop's Top Shops Benchmarking Survey is still open — but not for long. This is your last chance to a receive free, customized benchmarking report that includes actionable feedback across several shopfloor and business metrics.

.jpg;width=70;height=70;mode=crop)