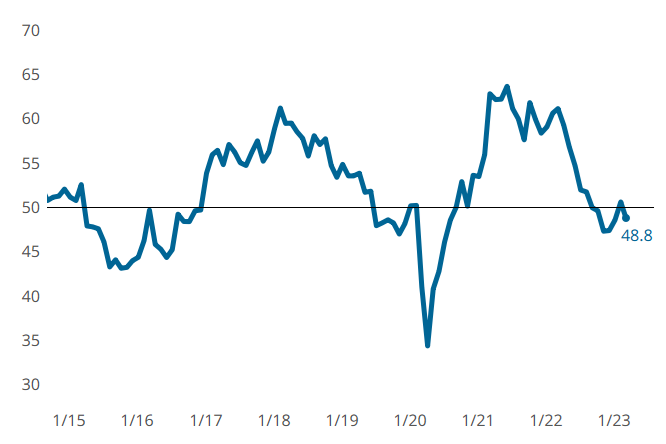

91ĘÓƵ GBI Contracted in March After One-Month Reprieve

February’s call for cautious optimism was well placed…market dynamics in March put a damper on what had been metalworking activity’s modest re-entry to growth mode in February.

Share

- The March index closed at 48.8, down almost two points, posting about the same index as January.

- Five of six components continued to move in directions of contracting slower or growing faster (employment) on a three-month moving average.

- The same types of movement in the same components were associated with a GBI that had tiptoed out of the (contraction) woods last month. Caution appears to have crept back in March.

- Additional evidence of caution comes from the future business metric (separate from GBI calculation.) It had been expanding, reflecting growing optimism each month since December 2022, but leveled off in March.

- Production slid into growth mode (just barely…) in March for the first time since August 2022.

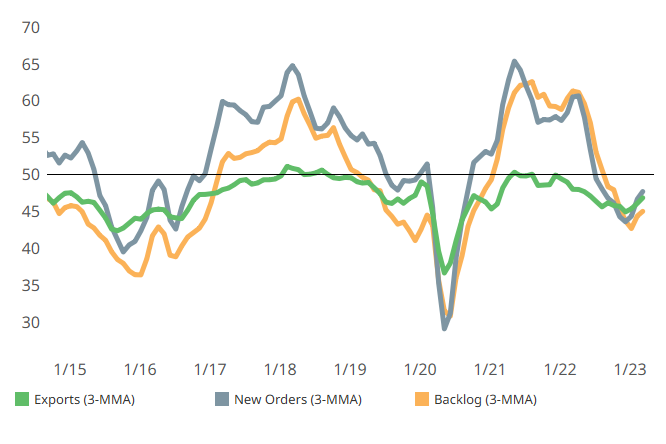

- New orders, exports, and backlog still contracted in March, again at a slower pace.

- Supplier deliveries continued to lengthen more slowly as supply chain woes wane.

- It appears that while optimism was tempered in March, pessimism was kept at bay to net a month of solid metalworking activity.

91ĘÓƵ GBI contracted again in March after a one-month reprieve.

More of the same (slowing contraction) for components, new orders, exports, and backlog is associated with metalworking’s modest GBI downturn in March.

More of the same (slowing contraction) for components, new orders, exports, and backlog is associated with metalworking’s modest GBI downturn in March.Related Content

-

Optimism Grows as 91ĘÓƵ Index Improves Again in November

A sharp increase in future business expectations underscores hopeful conditions in 2025.

-

Last Chance! 2025 Top Shops Benchmarking Survey Still Open Through April 30

Don’t miss out! Modern Machine Shop's Top Shops Benchmarking Survey is still open — but not for long. This is your last chance to a receive free, customized benchmarking report that includes actionable feedback across several shopfloor and business metrics.

-

91ĘÓƵ Activity is on a Roll, Relatively Speaking

February closed at 47.7, up 1.4 points relative to January, marking the third straight month of slowed contraction.