What Sandvik's Mastercam Acquisition Means For Users

While Sandvik says it plans to give recent acquisition Mastercam independence and keep its software platform-agnostic, the company also plans to leverage its new reach into the small to medium manufacturers to cross-sell tools.

Share

In July and August 2021, Sandvik acquired three different companies: metrology and automation providers DWFritz Automation, end-to-end CAD/CAM software developer Cambrio and Mastercam developer CNC Software. The former two already added significant new capabilities to Sandvik’s offerings, but the last acquisition marks a clear leap from Sandvik into the CAM market. What does this mean for the future of the company, or for Mastercam users, who make up the largest install base in the CAM market? Sandvik CEO Stefan Widing, CFO Tomas Eliasson and design and planning automation president Mathias Johansson addressed these questions in a recent conference call to investors.

Why Acquire Mastercam?

Sandvik leaders say the company’s mission in purchasing Mastercam is to continue automating the manufacturing chain for small to medium enterprises (SMEs) and to deliver competitive point solutions for large OEMs. The company plans to deliver open and agnostic products to simplify integration with its new subsidiaries’ existing installed bases, and hopes to generate recurring revenues through strong offerings in CAM, design for manufacturability and production logistics.

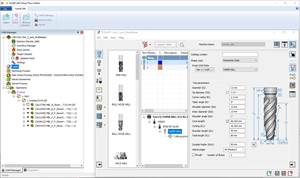

Access to CNC Software’s CAM software and customer base (particularly the SMEs) was particularly appealing to Sandvik, as it views CAM as a centerpiece in data capture. Sandvik also believes this acquisition puts it in a unique market position, with its existing stockpile of tool and cutter data creating additional value for Mastercam. The company plans to leverage both the newly obtained customer base and its tool data to cross-sell tools.

What Stays the Same?

Sandvik says it believes Mastercam and Cambrio will compliment each other, emphasizing Cambrio for molding and Mastercam for more general machining. This plan for software with different specialties mirrors the relationship Sandvik plans for the two brands to have with fellow subsidiary CGTech’s verification software.

The Mastercam team will stay relatively independent, with the parent company saying it will not mandate any particular changes to business. Sandvik executives did mention their belief that collaboration between Mastercam and other subsidiaries will arise where the companies themselves believe they can collaborate. Sandvik will also encourage knowledge sharing, and plans for both R&D resources and efficiency gains to be shared across companies.

Sandvik believes this collaborative push between its subsidiaries will improve applied machining strategies, benefiting customers. The company further plans to integrate additive and subtractive manufacturing expertise under its umbrella, developing a common “manufacturing centric” platform.

By bringing together expertise from different organization, Sandvik leaders believe the company will create new automated processes for customers, improve customer intimacy and open up opportunities for new sales models.

Why Use a United Ecosystem?

Sandvik’s executives say they believe positive, added value between brands under the same umbrella appeals to shops wanting a smoother, faster platform. Sandvik’s subsidiaries will continue to be platform-agnostic and collaborate with competitors — one executive going so far as say doing otherwise would anger customers and prove a surefire way to lose market share — but the additional speed and smoothness from using multiple pieces of software under the Sandvik umbrella will be the major selling point of its united ecosystem.

Related Content

Bringing Machining In-House to Keep up With Demand for Offroading Parts

To meet demand increases for its Ford offroad industry components, supplier RPG Offroad brought its machining processes in-house, saving the company nearly $50,000 per month. Here’s how its choice of integrated CAD/CAM software made it happen.

Read MoreThe Power of Practical Demonstrations and Projects

Practical work has served Bridgerland Technical College both in preparing its current students for manufacturing jobs and in appealing to new generations of potential machinists.

Read MoreBuilding A Powerful Bridge from the CAM Programmer to the Shop Floor Operator

SolidCAM for Operators provides a powerful bridge from CAM programming to the shop floor to best streamline the machine shop process with its CAM part simulation. It provides a clear picture to the operator for setup and prove-out, enables minor G-Code changes and avoids crashes, broken tools and scrapped parts.

Read MoreBlueprints to Chips: CAD/CAM Tips and Tricks

This collection of articles delves into the latest CAD/CAM innovations, from AI-driven automation and optimized tool paths to the impact of digital twins and system requirements.

Read MoreRead Next

Machine Shop MBA

Making Chips and Modern Machine Shop are teaming up for a new podcast series called Machine Shop MBA—designed to help manufacturers measure their success against the industry’s best. Through the lens of the Top Shops benchmarking program, the series explores the KPIs that set high-performing shops apart, from machine utilization and first-pass yield to employee engagement and revenue per employee.

Read MoreAMRs Are Moving Into Manufacturing: 4 Considerations for Implementation

AMRs can provide a flexible, easy-to-use automation platform so long as manufacturers choose a suitable task and prepare their facilities.

Read More